7 Tax Strategies To build Wealth For prime-Income Earners

페이지 정보

본문

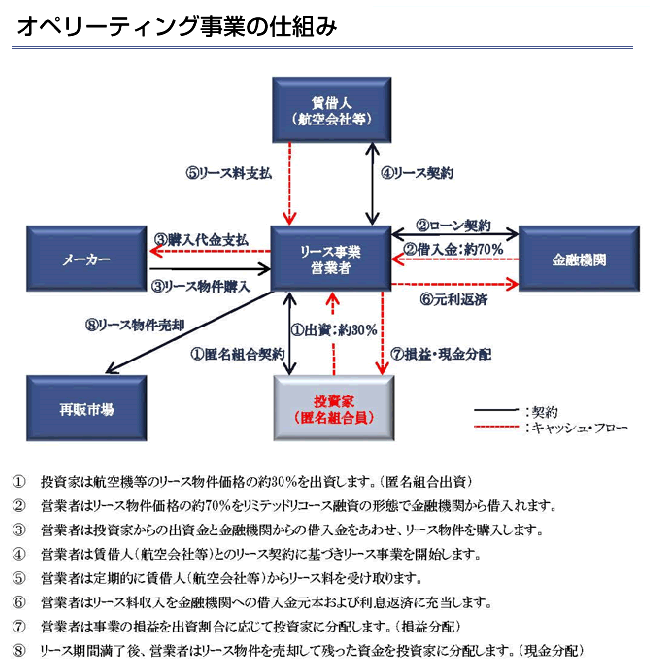

A certified monetary advisor will aid you understand what is possible and what the ultimate numbers would possibly look like for you. Superannuation is one of the crucial tax-efficient buildings accessible to Australians. As well as, if you are over 60, you possibly can take advantage of the superannuation pension section, which signifies that earnings within the account are tax-free. Clements’ unique bill would have phased out the inheritance tax entirely, whereas the amendment reduces some charges. But elevating the doc stamp drew opposition from Norfolk Sen. Rob Dover, who mentioned that reasonably priced housing is a huge downside in Nebraska and that elevating the price of selling a home would exacerbate that. Working Lease: Working leases don't seem on the balance sheet, which could make a company’s financial position appear stronger, with lower liabilities and higher return on property. Finance Lease: Finance leases are capitalized on the balance sheet, increasing both belongings and liabilities. This may have an effect on monetary ratios and should affect how the corporate is viewed by buyers and creditors. In spite of everything, it’s an indicator that you’re doing nicely. Both manner, there’s no getting round paying taxes completely (that’s called tax evasion, and it’s illegal), tax minimization, on the other hand, is completely legit. That starts with looking at methods to scale back your taxable income. What's taxable revenue? First things first, let’s clarify taxable revenue.

What is Corporate Tax Planning? Corporate tax planning is a necessary facet of managing a business’s funds, allowing companies to reduce their tax liabilities legally and optimize their profitability. This article will cover the basics of corporate tax planning for CA Exams, frequent strategies, sorts, scope, techniques, and the method concerned. What's Corporate Tax Planning? Corporate tax planning refers back to the strategic approach of arranging a company’s financial affairs to cut back its tax burden while adhering to tax laws and オペレーティングリース リスク rules. This entails using numerous methods reminiscent of selecting essentially the most favorable tax jurisdictions, deferring income, maximizing deductions, and utilizing tax credits. Beyond this period, the asset won't be performing at its greatest and will not be cost-effective for the business. 2. Salvage Worth: Salvage value is the worth of the asset at which it may be offered publish the helpful life of the asset. Three. Price of the asset: It consists of taxes, setup, and delivery bills.

And, the truth is, they are going to take pleasure in the same charges and allowances. Up to now, the regulation was different for each groups. Non-residents could find yourself paying up to eighty% more inheritance tax on assets obtained. Nonetheless, after a new legislation got here into power in 2015, the state of affairs modified utterly. Now the regulation can't be discriminatory: it applies to residents and non-residents alike. If you are a non-resident, but you obtain belongings in Spain by means of inheritance, you could take into consideration that you have to pay inheritance tax.

- 이전글What Drove Germany to Turn out to be So Powerful? 24.12.28

- 다음글What is An Operating Lease? 24.12.28

댓글목록

등록된 댓글이 없습니다.