What's An Working Lease?

페이지 정보

본문

The sort of lease permits corporations to make use of belongings without the financial risk of depreciation or obsolescence, and it offers potential tax benefits and favorable accounting treatment. Though not appropriate for each business or asset type, working leases are extensively used in industries reminiscent of office leasing, transportation, and manufacturing. As monetary laws and standards evolve, companies must rigorously consider the structure, costs, and accounting implications of operating leases earlier than making leasing decisions.

What about your small business? How have you learnt if an operating lease is best than a finance lease when it comes to securing vehicles for your enterprise fleet? There are advantages with each operating and finance leases and one may match higher than the other for you. The best alternative will rely upon a variety of things. An working lease works similar to a rental agreement in that you just only pay to be used of the car, and it can free up capital that will in any other case be tied up with asset ownership. Keep detailed data of these bills, together with receipts and documentation of the enterprise purpose so you can cut back your business tax invoice. 5. Automobile Bills: If you employ vehicles for enterprise functions, you could possibly deduct expenses resembling gasoline, upkeep and repairs, lease payments, and depreciation. Keep correct data of both personal and enterprise use of the car to calculate the deductible portion. 6. Make the most of accelerated depreciation strategies: Make the most of accelerated depreciation strategies, similar to bonus depreciation or Part 179 deduction, to speed up the tax benefits of asset purchases.

Minimizing your potential revenue taxes requires an everyday evaluation of your monetary image and the current tax reduction strategies out there to you. The truth is, tax planning can be a yr-spherical exercise. We give you a smart record of the most typical tax reduction options that could be of profit. Although your tax picture is exclusive to you, there are widespread tax discount strategies to contemplate and discuss along with your monetary and tax advisors. Sure, the Working Lease service is aimed toward private and enterprise users and the self-employed. To rent the service, you may go to your nearest CUPRA retailer along with your private and financial paperwork. Please enquire with your native CUPRA retailer about the specific documents required. With the CUPRA Working Lease service, you will have roadside help 24 hours a day. The leasing/rental guidelines and nationwide laws differ in every country.

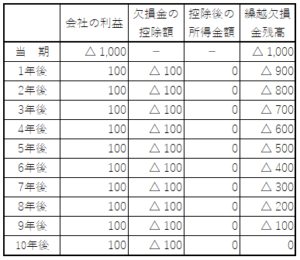

Four. Tax Advantages: Depending on the rules and terms of the lease, there may be tax benefits associated with leasing. An organization's taxable earnings is reduced by the fact that lease payments are frequently deductible as operating expenditures. 5. Optimising Steadiness Sheets: By utilizing working leases, firms can take away leased assets from their stability sheets. By understanding the intricacies of operating leases, lessees could make knowledgeable choices that align with their financial and operational aims. Operating leases play a significant role in the financial technique of many companies, offering a solution to access assets without the hefty upfront costs associated with buying. Nonetheless, the monetary impression of those leases is multifaceted and オペレーティングリース リスク extends past simple money stream considerations. From the angle of a lessee, operating leases are a type of off-steadiness-sheet financing, which suggests they do not seem as debt on the company's steadiness sheet. If business situations are such that the interest doesn't have value or the partner is considering abandonment, essential points should be thought of. Beneath present guidelines, beneficial properties allotted to carried pursuits in funding funds are handled as long-time period capital beneficial properties only if the investment property has been held for more than three years.

- 이전글Inheritance Taxes In Spain For Expats 2024 24.12.28

- 다음글Gold News Cheet Sheet 24.12.28

댓글목록

등록된 댓글이 없습니다.