Gold ETFs Guides And Reports

페이지 정보

본문

Gold and silver is correct for everybody so long as they have cash of their pockets. If you're investing now and your timing (and luck) is right then likelihood is that you will make huge earnings (upto 300%). Otherwise, you'll either be caught with the shares or you'll have lost your cash. Right now, you are most likely sporting your favorite hue -- taupe, lavender, pink? As it isn't necessary for pink sheets to disclose their info, you should have a really laborious time discerning the good from the bad and the bad from the ugly. Well, your greatest wager can be to speculate within the small and upcoming (and promising) companies listed in the pink sheet or the OTCBB. Commodity suggestions suppliers and firms which might be contain within the the market performs a major position in providing useful ideas in treasured metals, vitality, gold value, silver prices, copper and different metals. These are corporations with market capitalizations of around 50 million to 300 million USD and these will not be listed on the key exchanges (which is why they are listed right here in the first place). Spend money on stocks which are involved in market insulated sectors equivalent to healthcare. Exchange commerce funds normally known as Exchange-Traded Fund (ETFs) are kinds of mutual funds that frequently commerce on the stock exchange identical to normal stocks.

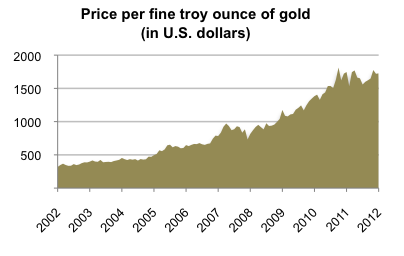

Typically, a purchaser with rather a lot of money would buy a large quantity of a specific stock for some worth after which launches a misinformation marketing campaign about it. The one large downside to microcap buying and selling is the truth that you will always discover extra misinformation and rumors than precise knowledge. Never fall prey to hasty trading. If you happen to stay away from the bigger premiums and graded coins, they can be acquired at affordable premiums in relations to the spot value. The fund has an annual tracking error of around 0.93%. The tracking error is the distinction between the value of the ETF and the underlying spot value of gold. Which components drive the price gold worth to maneuver. During this time, the investor sells all his shares at a high worth and thus makes a huge revenue. There isn’t an overall proportion of one stock big sufficient to make a big impact at one company and that’s on objective, to make sure it doesn’t carry down the value of the complete ETF. To make easy understanding about commodity market we will break up the commodity in two half: considered one of them is named Hard Commodities and second one we are able to say Soft Commodities.

Typically, a purchaser with rather a lot of money would buy a large quantity of a specific stock for some worth after which launches a misinformation marketing campaign about it. The one large downside to microcap buying and selling is the truth that you will always discover extra misinformation and rumors than precise knowledge. Never fall prey to hasty trading. If you happen to stay away from the bigger premiums and graded coins, they can be acquired at affordable premiums in relations to the spot value. The fund has an annual tracking error of around 0.93%. The tracking error is the distinction between the value of the ETF and the underlying spot value of gold. Which components drive the price gold worth to maneuver. During this time, the investor sells all his shares at a high worth and thus makes a huge revenue. There isn’t an overall proportion of one stock big sufficient to make a big impact at one company and that’s on objective, to make sure it doesn’t carry down the value of the complete ETF. To make easy understanding about commodity market we will break up the commodity in two half: considered one of them is named Hard Commodities and second one we are able to say Soft Commodities.

If you're new to such stock scene, it's endorsed that you just discover the OTC Reporter's site completely before you make an investment. It provides credible and timely information on the stock state of affairs and is a very useful tool. It is introduced to you in a simple, easy to read format and offers you very helpful data ranging from the positive factors made on the earlier day to live data and studies on varied stocks. We've got said this at the outset not to scare you however to inform you that these stocks are very risky and that the risks, as effectively because the returns, are very high. Growth stocks just happen to carry some further dangers (and benefits) as well. I would not mind putting a few of my money into startups, but the dangers do appear too high in Singapore and many of the bets would seem too long term to me.

Now consider the draw back risks of a resumption of the bear market south of $1165 on break of which down to a possible $1050. But if banking is the reason for the enterprise cycle, aren't the banks also part of the private market economic system, and cannot we therefore say that the free market continues to be the culprit, if solely within the banking segment of that free market? Some business could present extra services like storage house services or insurance coverage policy coverage- consider what straightens best along with your monetary funding strategy. While it uses advantages like diversification and defense versus inflation, it additionally offers obstacles such as liquidity concerns and storage house costs that may forestall some investors. Bullion gold and silver offers the most liquidity and fewer spreads on supply and demand. On December 12, AEM announced the acquisition of O3 Mining Inc. (OIIIF) by a wholly-owned subsidiary that gives to acquire the entire issued and outstanding frequent shares of O3 Mining for $1.67 in money per widespread share. We imagine that we're recognized within the mining trade for our world leading ESG practices, for having one among the bottom GHG intensities and for working in protected jurisdictions.

In case you loved this short article and you wish to receive much more information relating to gold price assure visit our site.

- 이전글Am I Bizarre Once i Say That Paypal Fee Calculator Us Is Useless? 25.01.05

- 다음글My Life, My Job, My Career: How Three Simple Gold Vs Silver Investment Helped Me Succeed 25.01.05

댓글목록

등록된 댓글이 없습니다.