Definition, Types, And Calculation

페이지 정보

본문

Salvage value is the amount you expect to be ready to obtain for the asset at the top of its usable life. Subtract salvage value from asset cost to get the overall worth that this asset will present you over its lifespan. Divide this by the estimated helpful life in years to get the amount your asset will depreciate yearly. Corporate tax planning helps companies cut back tax liabilities and maximize profits. By identifying eligible deductions and credit, companies can lower their tax bills and enhance money flow. Tax Savings: Reduces tax obligations by utilizing tax-saving opportunities. Enhanced Profitability: Redirects funds that would’ve gone to taxes into worthwhile investments. Higher Money Movement: オペレーティングリース リスク Strategic timing of bills and income deferral to improve liquidity. Compliance: Ensures adherence to tax legal guidelines and avoids penalties. Aggressive Edge: Reduced taxes allow better pricing and investments in progress, fostering innovation.

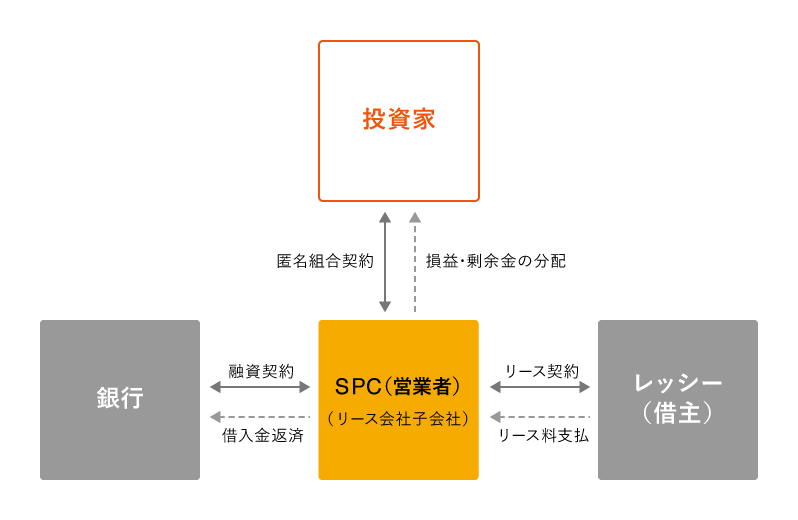

Under a finance lease, risks and rewards which might be associated to the leased asset are transferred to the lessee. Beneath an operating lease, risks and rewards which might be associated to leased asset remain with the lessor. A third possibility is an automatic identification of the lease type, both finance or operating, primarily based on the defined thresholds within the e-book. EETCs are generally considered to be a kind of finance leasing. Leasebacks, through which a company purchases an aircraft after which leases the aircraft back to the vendor. This allows an airline to promote its aircraft and receive a big amount of money whereas persevering with to make use of the aircraft under a lease settlement with the buyer. By using an intentional, effectively-thought-out method to your tax preparation, you’ll be in a extra advantageous tax state of affairs once you file. If you’re looking for a method to assist handle the finer particulars of your tax technique, consider using FreshBooks accounting software. This software helps you track and categorize expenses, tax credit, contributions, and itemized deductions all year long, helping you optimize your tax technique and save as much cash as potential. Strive FreshBooks free right now.

Most small companies will need to utilize a variety of the following tax-planning methods. I am stating the obvious right here, however the first step in tax planning for your business is to look for tactics to reduce your Adjusted Gross Revenue (AGI). I can’t tell you the way typically I've reviewed tax returns for high-income business homeowners who took practically no tax deductions against their incomes. Units of manufacturing and the sum of the years’ digits aren’t allowed for tax depreciation. For tax purposes, most tools and gear are thought of purchased in the middle of the year, regardless of when they’re bought. Actual property is taken into account to be bought in the middle of the month during which it’s actually bought.

- 이전글Proof That Gold News Actually Works 24.12.28

- 다음글5 Reasons why Companies Prefer Working Leases 24.12.28

댓글목록

등록된 댓글이 없습니다.